For decades, the Chief Financial Officer was measured by their ability to report accurate financials, manage budgets, and safeguard the company’s bottom line. That role has not disappeared, but in today’s environment of constant M&A activity, fragmented systems, and data-driven decision-making, the CFO’s job description has expanded dramatically.

More and more, CFOs are becoming the de facto Chief Data Officer (CDO) of their organizations, whether the title is on their business card or not.

Why the Shift Is Happening

Several forces are driving this evolution:

-

Complex M&A Landscapes

When companies merge or acquire, finance teams are immediately faced with multiple ERPs, CRMs, and operational platforms that do not talk to each other. Waiting months or even years for IT-led integration projects is no longer viable when stakeholders expect fast answers. -

The Rise of Real-Time Decision-Making

Quarterly reporting is no longer enough. Boards, investors, and deal teams want up-to-the-minute visibility. Delays in consolidating financial data can mean missed opportunities and poor risk management. -

The AI and Analytics Imperative

Everyone wants AI-driven insights, but the outputs are only as good as the inputs. Without clean, unified data, CFOs risk feeding executive teams with numbers they cannot fully trust. -

Compliance and Audit Pressures

Regulators and auditors expect accurate, accessible, and auditable financial data. CFOs who cannot demonstrate control over data flows leave their organizations vulnerable.

What This Looks Like in Practice

The modern CFO’s responsibilities now extend well beyond traditional finance. In practice, finance leaders are:

-

Pushing for system integration earlier in the post-close process, demanding clarity within weeks instead of months

-

Taking ownership of data governance, ensuring that financial, operational, and compliance data align to a single version of the truth

-

Championing finance-first technology initiatives, from cloud ERP integrations to AI-powered forecasting models

-

Partnering closely with IT and CIOs, not just to reduce costs but to enable faster, smarter decision-making across the organization

The Human Impact: Why This Matters

Behind every delayed integration or incomplete report are finance teams working late nights to reconcile spreadsheets by hand. When systems do not align, CFOs carry not just the technical debt but the human toll: burnout, errors, and risk.

Shifting into the role of Chief Data Officer is not only about protecting numbers, it is about protecting people and the decisions they drive.

How CFOs Can Embrace the Role

-

Set the Expectation for Real-Time Visibility

Make it clear that waiting months for ERP alignment is no longer acceptable. Day-one visibility should be the goal. -

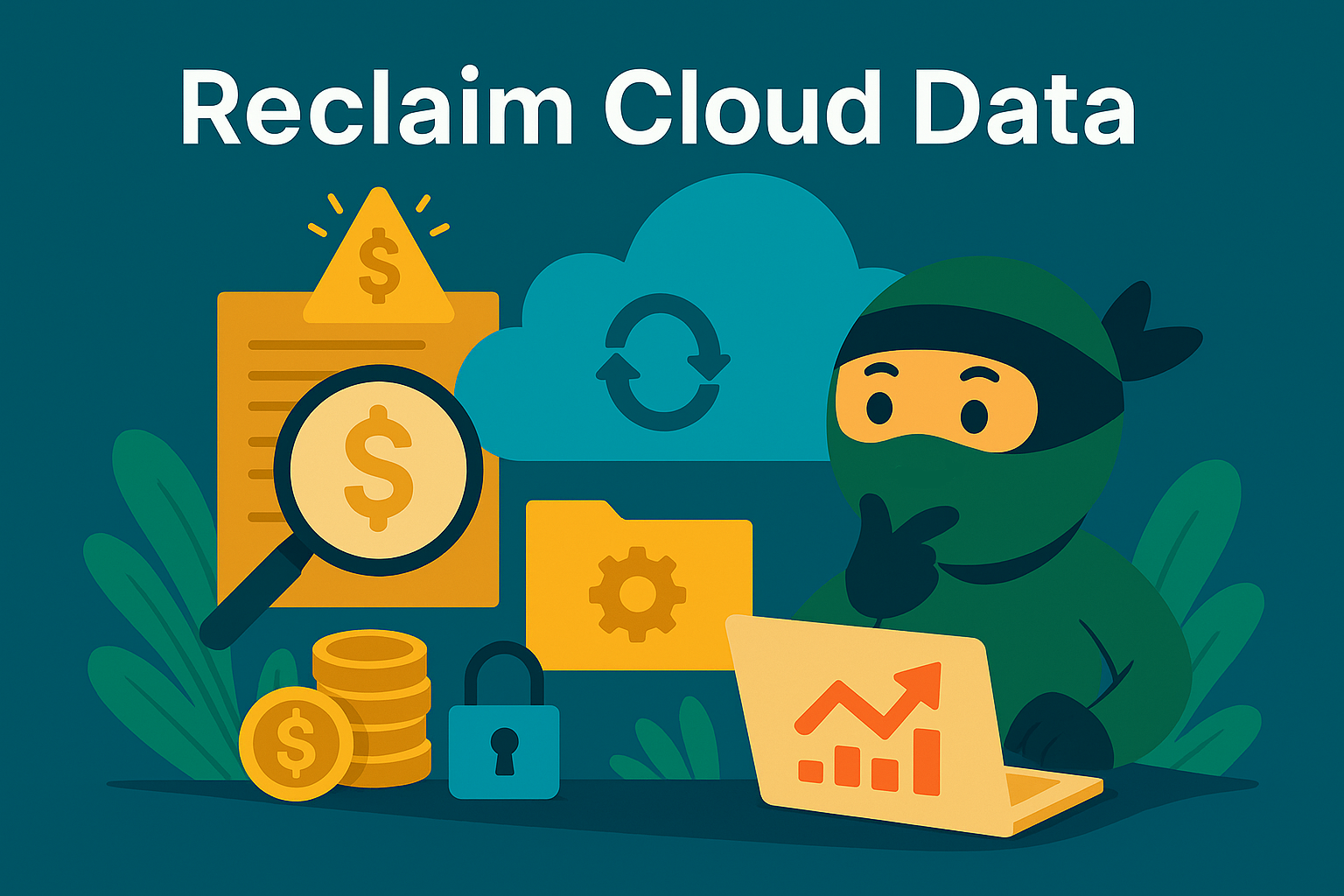

Invest in Flexible Data Integration Tools

Relying solely on IT’s integration roadmap is not enough. Look for solutions that unify data quickly without waiting for a full system rebuild. -

Build a CFO-CIO Alliance

Treat IT as a strategic partner, not a service provider. The strongest organizations pair financial strategy with technical execution. -

Leverage AI Responsibly

Use AI and analytics tools, but ensure your data foundation is solid first. The right numbers matter more than flashy dashboards. -

Prioritize Auditability

Regulators are watching closely. Make sure your real-time systems produce audit trails that stand up to scrutiny.

The Bottom Line

The role of the CFO is evolving. You are no longer just a steward of financial reports, you are the architect of the data environment that drives the business forward. Those who embrace this role will not only safeguard their organizations but also create a competitive advantage in an era where speed and accuracy are everything.

At Stelth, we work with CFOs and deal teams navigating this exact challenge. If you are preparing for or emerging from a transaction and struggling with fragmented systems, let’s talk. The faster you gain real-time clarity, the faster you can realize the value of your deal.