Turning Post-Close Chaos into Opportunity

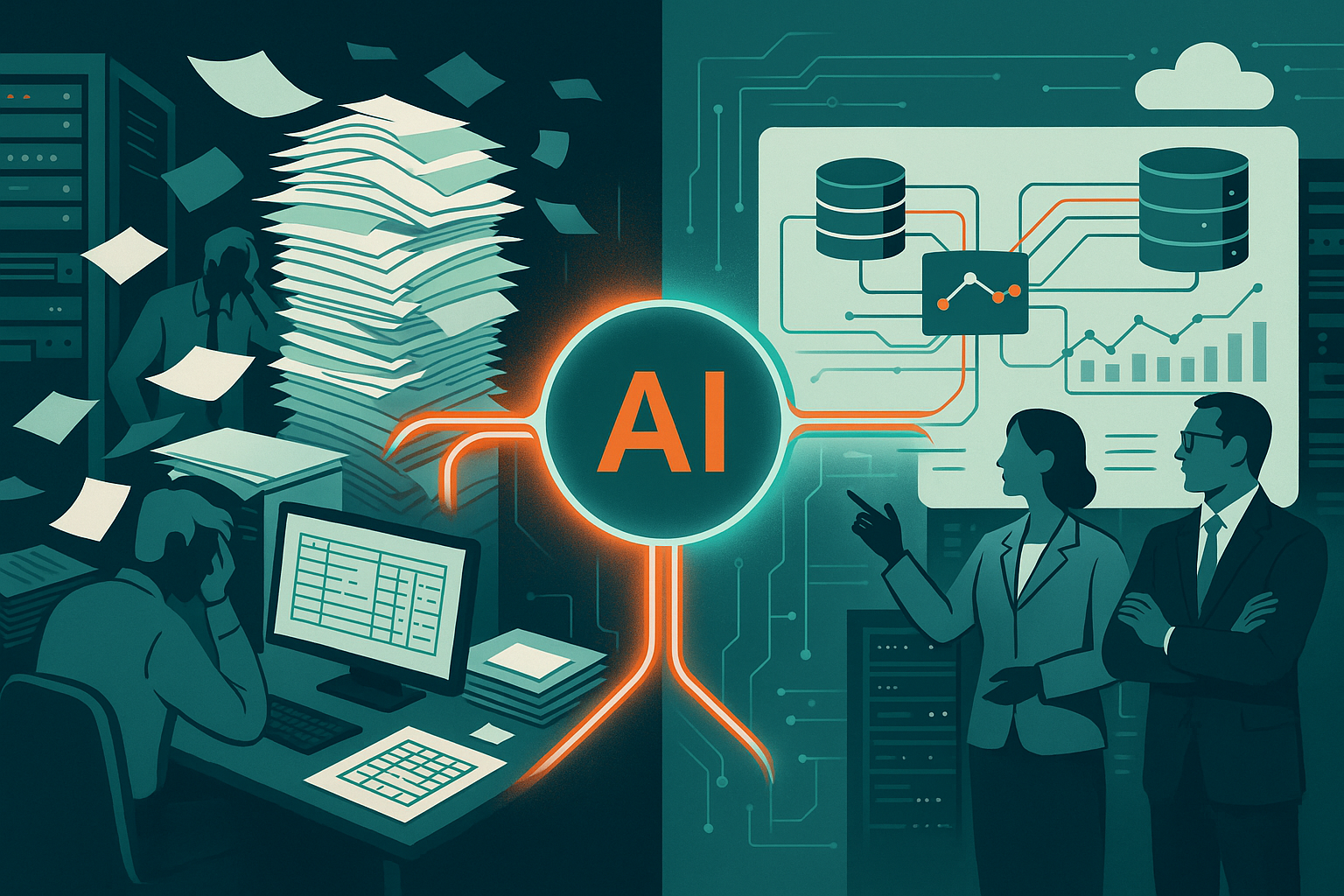

M&A deals don’t fail in the boardroom.

They fail behind the scenes buried under mismatched general ledgers, duplicate SKUs, missing invoices, and half-migrated CRM records.

For all the strategy that goes into a deal, the technology and operations teams are often left with a single instruction: “Make it work.”

But in 2025, “just make it work” isn’t good enough. Fortunately, AI is changing the post-close playbook if you know how to use it.

The Real Battle Is Post-Close

Most M&A playbooks focus on due diligence, legal structures, and financing. But once the ink dries, the value of the deal hinges on how fast the combined organization can operate like a single entity.

That means:

- Unified financial reporting

- Clean, comparable operational data

- Systems that talk to each other

- Teams working from one source of truth

Traditionally, getting there has taken months—if not years. AI can change that timeline dramatically.

AI Can Do What Spreadsheets Can’t

Where does AI shine in M&A integrations?

- Data Mapping & Normalization

Different chart of accounts? No problem. AI can suggest mapping between financial structures, validate historical patterns, and flag anomalies faster and more accurately than any human-led spreadsheet audit. - Duplicate Detection Across Systems

Between vendors, customers, SKUs, and employees, duplicates creep in from all sides. AI models can scan and de-dupe based on fuzzy logic, metadata, and usage patterns, not just exact string matches. - Workflow Acceleration

AI-driven tools can identify high-friction approval flows, repetitive tasks, and disconnected systems then auto-generate streamlined processes for the merged entity. - Intelligent Forecasting & Rollups

With two sets of data stitched together, AI can generate comparative forecasts, combined cash flow models, and department-level rollups without manual wrangling.

AI Is Not Magic, It’s Leverage

This isn’t about replacing finance teams or IT leads. It’s about giving them the leverage to get through integrations faster, with fewer errors, and with real visibility along the way.

Think of AI as a “post-close co-pilot” It works 24/7, flags inconsistencies, and scales with complexity.

But like any co-pilot, it needs direction:

- Garbage in still means garbage out

- AI models must be trained with the appropriate business context

- Automation without oversight is just faster failure

It’s Not the Future. It’s Now.

At Stelth, we’ve worked with deal teams and finance leaders trying to unify systems under intense pressure. In every case, the biggest hurdle isn’t the technology, it’s the lack of strategy around the integration process.

That’s why we built Conduit, to make AI practical in the moments that matter most. It’s not just a platform. It’s a bolt-on brain for your financial systems that can:

- Integrate ERP data in days, not months

- Normalize GLs and map accounts automatically

- Give finance teams confidence in their numbers

- Turn data into information

If your post-close playbook is just a Gantt chart and a prayer, it’s time to upgrade. AI isn’t just for product teams anymore. It’s the smartest way to protect your deal value.