For CFOs, the ink on the deal is barely dry before the clock starts ticking. The first 100 days after a merger or acquisition are critical. Visibility, alignment, and momentum all matter. Yet too often, finance leaders find themselves flying blind, unable to answer basic questions like: “Where are we actually making money?” or “Which ERP is telling the truth?”

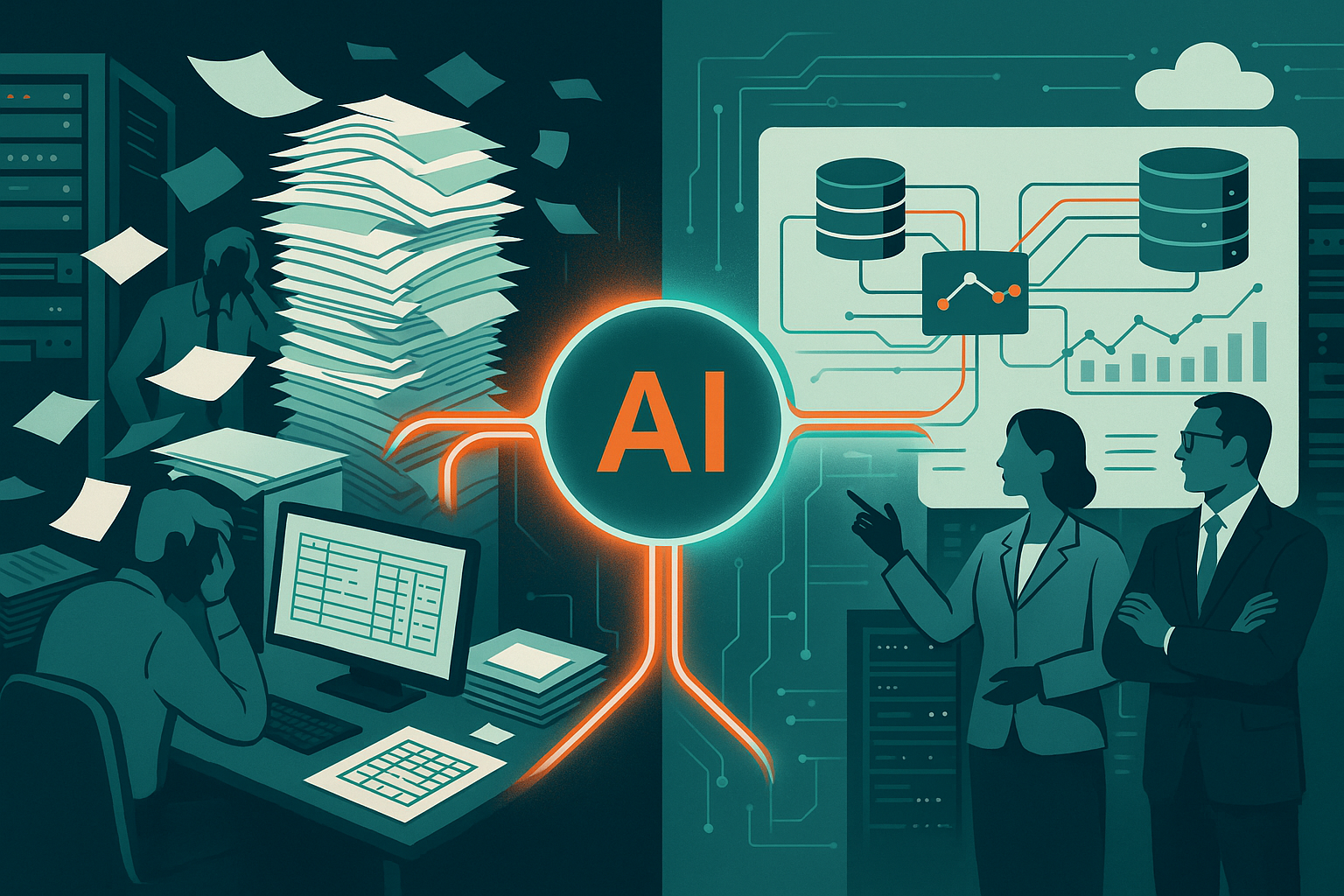

The culprit isn’t strategy, it’s data. Or more accurately, a lack of clean, connected, and trustworthy data. M&A is a data problem in disguise, and without a clear plan to address it, the finance team becomes reactive when they need to be leading.

1. Competing Systems, Competing Truths

Post-close environments often inherit two or more ERPs, CRMs, and planning tools. Each has its own data structures, assumptions, and reporting cadence. What’s worse: the same KPI can return wildly different results depending on which system you ask.

The impact? Executive alignment falters, confidence in reporting erodes, and critical decisions are delayed as teams argue over whose numbers are “right.”

Finance teams spend weeks reconciling numbers instead of advising the business just to produce reports everyone still questions.

2. Manual Workarounds Don’t Scale

Most integration plans fall back on spreadsheets by extracting data, normalizing it manually, stitching it together on tight deadlines.

The result? Highly skilled finance professionals are stuck doing repetitive, manual work, introducing errors and slowing down time-to-insight.

In deals with a strong growth or optimization mandate, this kind of inefficiency becomes a serious liability. It’s hard to move fast when your reports are built on duct tape and luck.

3. No Line of Sight to Integration KPIs

Even when strategic objectives are clear (reduce COGS, improve margin, rationalize spend) it’s nearly impossible to measure progress if key data lives in silos.

What’s at stake? Teams can’t track whether integration efforts are paying off, which initiatives are working, or where to course-correct.

Integration KPIs need to be tracked early and often, but that requires an infrastructure that most companies simply don’t have on day one.

Closing Thoughts

The first 100 days define the integration. For CFOs, it’s a window of opportunity, but also a gauntlet of ambiguity, system mismatches, and incomplete insights.

Tech-driven finance leaders are shifting their focus earlier in the deal lifecycle. They are asking tough questions about data architecture, integration strategy, and systems alignment before the deal closes. It’s not about having a perfect roadmap; it’s about having visibility, adaptability, and speed.