While most M&A discussions focus on systems and financials, true value realization often comes later – when teams are aligned, tools are rationalized, and IT operations evolve into a strategic advantage.

Here’s how Stelth guided one acquisition through that transition – transforming a vendor-dependent office into a seamlessly integrated part of the parent organization’s IT fabric.

Background: A Classic Asymmetrical Acquisition

The acquiring company was a mid-market healthcare platform running a modern stack: Netsuite ERP, Salesforce CRM, and Microsoft 365 for collaboration. Its internal IT team handled infrastructure, security, and operational systems with a mix of in-house engineering and a few strategic vendors.

The target company? A single-site subsidiary using a mix of outsourced providers:

-

An MSP for support and networking

-

A VAR for licensing

-

Ad hoc consultants for Salesforce customizations

-

Google Workspace for email, documents, and calendar

-

QuickBooks for accounting

-

No dedicated IT staff

This wasn’t just a systems integration – it was a full IT uplift and operating model reset.

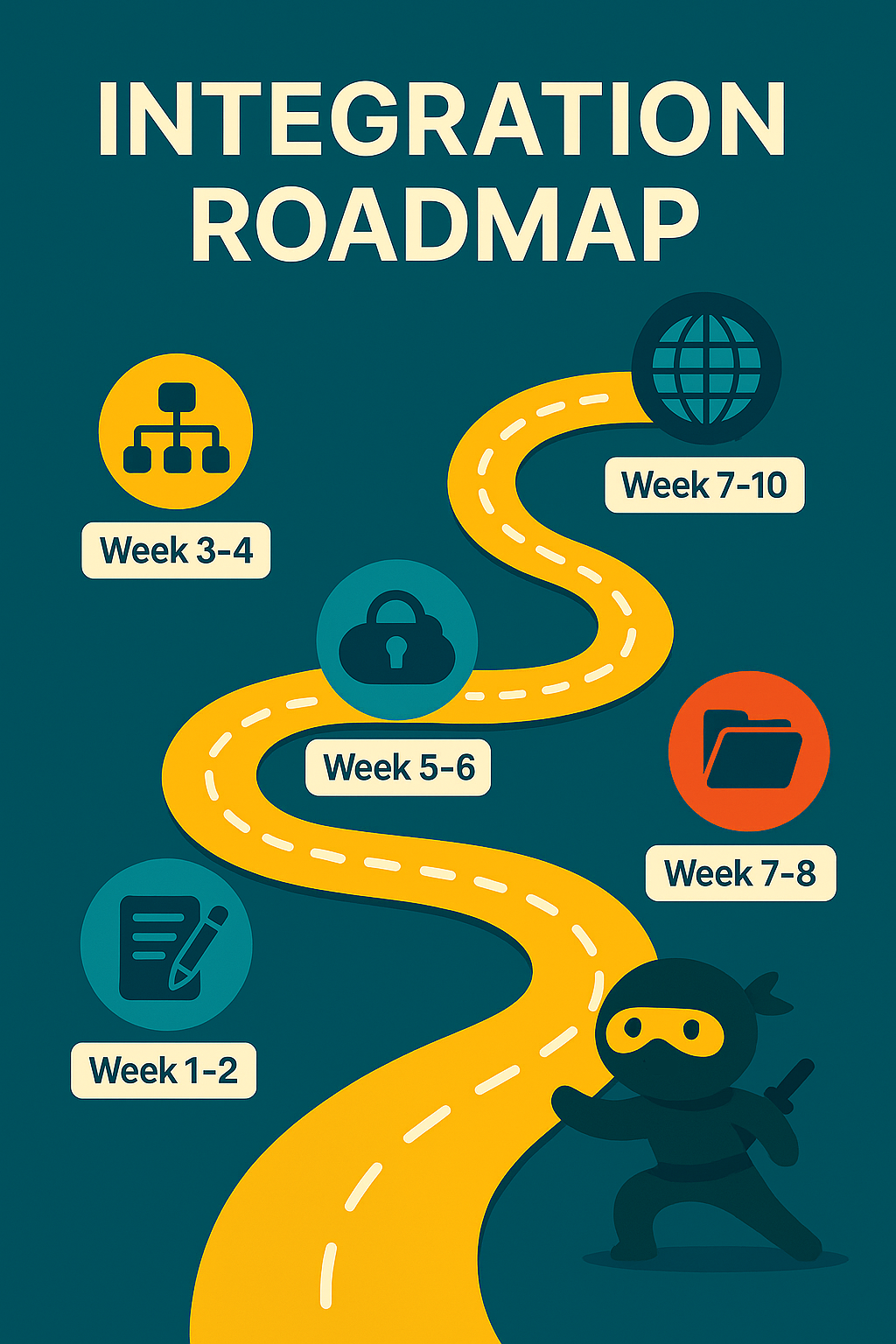

Step 1: Vendor Audit and Rationalization

Before any tech could be merged, we needed to map out:

-

Who was providing what service?

-

How were those vendors contracted and paid?

-

What licensing was active – and redundant?

We quickly found:

-

Overlap between MSP and VAR services (patching, procurement, licensing advisory)

-

Disparate endpoint tools (different AV, RMM, and encryption platforms)

-

Multiple license contracts for Microsoft and Salesforce – no bundling or volume benefits

What We Did:

-

Consolidated all licensing (Microsoft, Salesforce, AV) under corporate agreements

-

Terminated the local MSP and absorbed user support into the parent’s helpdesk

-

Standardized endpoint protection and device management across both teams

-

Migrated the VAR relationship to the primary procurement channel for streamlined renewals

By doing this early, we reduced IT vendor spend by over 40% and freed up local managers from chasing support across fragmented providers.

Step 2: Operational Design and System Integration

Finance Stack

The subsidiary was on QuickBooks with no integration into the broader finance operation. To keep financial reporting running:

-

We began with direct SQL-based exports from QuickBooks into a staging area

-

Built mapping logic to generate consolidated financials in Netsuite

-

Used this model to complete quarter-end close without disruption

-

Once stable, we migrated full QuickBooks history into Netsuite, eliminating dual system use

CRM

Both companies were running Salesforce, but without a shared schema or visibility.

-

We configured multi-org access with field-level sync between accounts

-

Merged marketing lists and aligned pipelines while preserving sales team autonomy

-

Designed post-close dashboards for leadership with cross-entity visibility

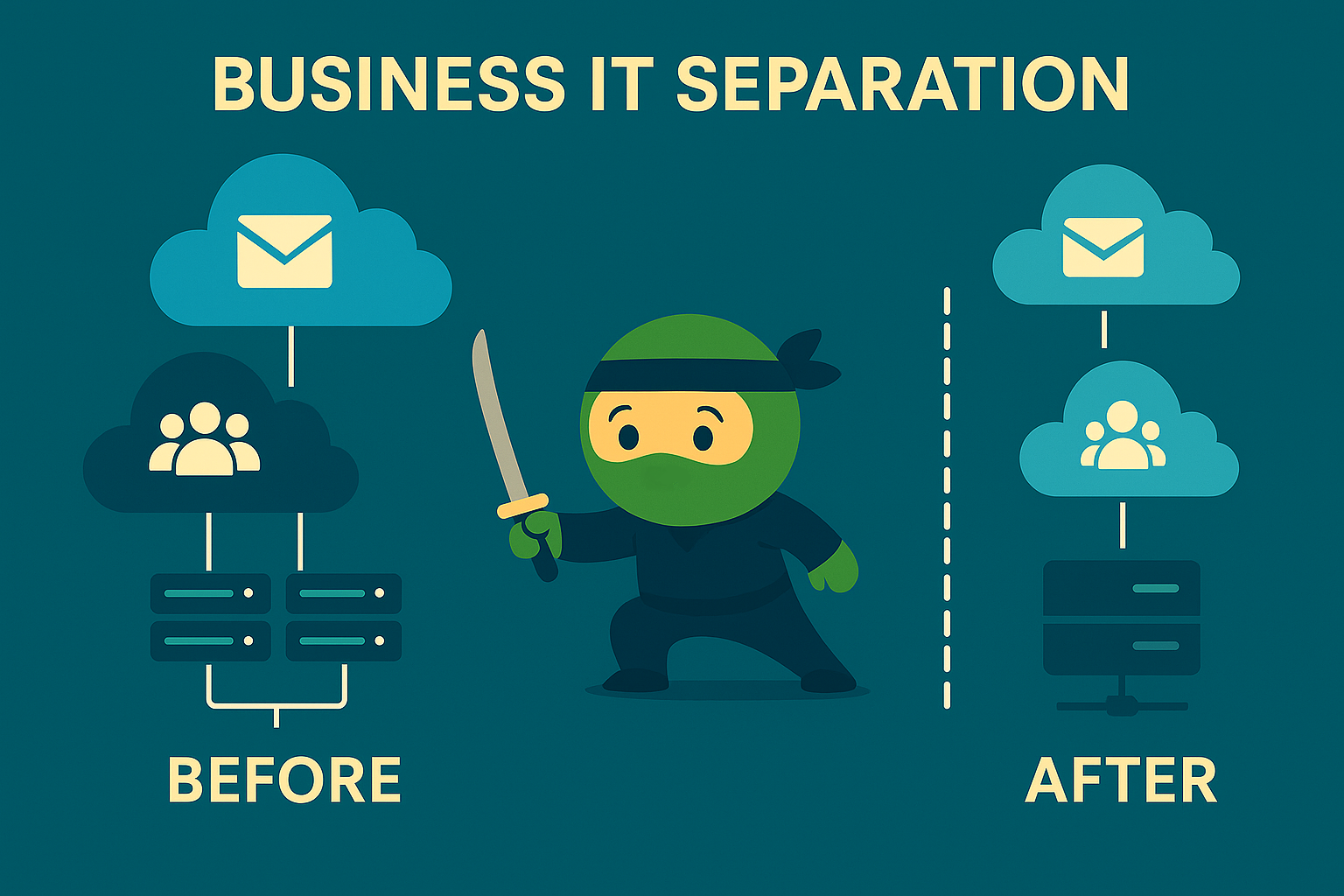

Productivity & Collaboration

The subsidiary used Google Workspace (Gmail, Drive, Calendar), which had to be folded into the Microsoft 365 tenant.

-

We migrated email, calendar, and files to Microsoft 365 using native migration tools and API connectors

-

Created custom labels and filters in Outlook to mirror Google workflows

-

Users were retrained on Teams, OneDrive, and SharePoint

Step 3: Infrastructure, Security, and Identity Alignment

File Servers and Domains

Each office had its own domain controller and file server stack. We:

-

Established inter-domain trust and mapped shared drives for immediate collaboration

-

Migrated files to SharePoint and OneDrive where feasible

-

Fully decommissioned the subsidiary domain post-migration

Endpoint and Security Stack

Workstations at the subsidiary ran SMB-focused tools – no central management, inconsistent patching.

-

Rolled out Intune for MDM and compliance policies

-

Standardized endpoint protection to align with corporate policies

-

Migrated physical servers into Azure, applying the same backup and patch strategy as corporate

The Human Factor: Design Without Disruption

While this deal had no headcount overlap, we still prioritized organizational clarity:

-

Created clear org charts showing system ownership post-integration

-

Documented SOPs for request routing, change control, and security incidents

-

Reassigned technical responsibilities from vendors to the corporate IT team – with escalation paths defined

Outcome: More Than an Integration

By the time the integration was complete, the subsidiary:

-

Operated entirely within the parent company’s IT framework

-

Had eliminated five separate vendors

-

Saw improved performance and user satisfaction across the board

-

Was prepared to scale with zero dependency on legacy infrastructure or siloed workflows

This wasn’t just cleanup – it was enablement.

Why It Matters

The goal of M&A isn’t to stitch two environments together – it’s to create a better one.

At Stelth IT, we specialize in:

-

Turning fragmented vendor ecosystems into strategic partnerships

-

Building unified operating models that actually scale

-

Ensuring no system, tool, or person is left behind

Whether you’re absorbing a single-site target or merging multi-entity platforms, we’ll help you elevate – not just integrate.